Investment trends in renewable energy

Investing in renewable energy companies or funds has the combined effect of boosting the potential returns of an investor’s portfolio and aligning their money with a beneficial outcome for the environment. Many portfolio managers are allocating a portion of their portfolios to clean and renewable energy as a mandate brought on by an increased awareness of ethical and social governance.

Furthermore, tax credits and government subsidies are expediting the adoption of clean energy by reducing the barriers to entry for new renewable energy projects. This is particularly prevalent in the US with the Biden administration pledging to achieve net-zero emissions, economy wide by no later than 2050. This has had a ripple effect across developed and emerging market economies, with more governments taking climate change and renewable energy more seriously.

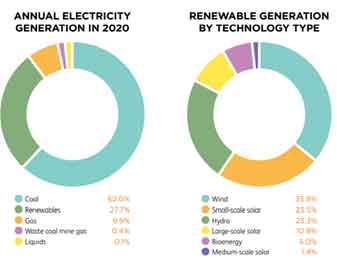

In the past five years, Australia’s renewable energy generation has almost doubled, increasing from 14.6% in 2015 to 27.7% in 2020.

There is clearly an investment thesis to be made, therefore we thought it would be prudent to bring investors up to speed with what’s going on in the world of renewables and what types of renewable energy investments are out on the market.

What are the main types of renewable energy sources:

Solar: Sunlight is one of the planets freely available and abundant resources. Solar energy is very well known and can be incorporated on a small-scale level through Solar panels on residential roofing which accounts for the majority of Australia’s solar energy capture. There is also a growing presence of large-scale solar farming operations some of which are listed on the Australian stock exchange.

Wind Energy: If you live and travel on the coast of Australia you would have noticed a wind farms popping up on the horizon. These windmills harness the power of the wind to spin a turbine, used to drive generators into a grid. Investors can get direct exposure to Wind Energy producing companies, as well as the companies that produce the wind turbines through Exchange Traded funds traded on the ASX. Although Solar and Wind Energy are by far the most popular renewable energy sources, they are considered “intermittent” energy sources that require the right conditions for them to generate energy. Federal Energy Minister Angus Taylor suggests that more resources need to be placed on gas, pumped hydro and transmission to balance the intermittent energy sources.

Hydropower or Hydroelectricity: Power is generated from great gravitational pressure forcing water through turbines generating energy. Most Australians will be familiar with hydropower through the Snowy Mountains Hydro scheme which was built in 1972. This took 25 years to complete and is capable of producing 4,500 gigawatt-hours of renewable electricity each year. Some companies (including an ASX listed one) are converting old mines into renewable hydro projects. One of the benefits of Hydropower is that water stores energy during low demand periods and can convert it to electricity during high demand periods.

Biomass energy: Biomass energy is the conversion of solid fuel derived from plant and organic materials into energy. This causes a much lower economic and environmental cost as it uses materials that can be reproduced at little to no harm to the environment.

Geothermal Energy: Geothermal energy harnesses the heat below the earths surface by either heating water or turning that water into steam to be used spin turbines to produce electricity. There are also plants that inject waste water into the ground, using the natural heating of the earth to turn it into usable power. Australia is considered a great resource for Geothermal energy and has many Geothermal based energy companies that trade on the stock exchange.

Ocean/tidal Energy: Similar to hydro energy, tidal energy is utilized by situating turbines to catch the flow of the tide. They can collect energy twice daily and the generation is often highly predictable making it valuable for capture.

What are the key things to look out for when investing in clean or renewable energy?

Is the market driven by hype or fundamentals:

What often happens when the world accepts that some new form of technology or process is “the way of the future” speculators jump on the bandwagon. This drives up the price of companies higher than their fair value. In fact, during 2020 the contagion led to some renewable energy indexes and exchange traded funds jumping up to 140% in the year. There was a subsequent sell-off with prices having levelled since then. Investors need to be wary that even if a company is moving toward success, buying them at too high of a valuation can lead to being unable to recoup a return on their investment for several years if the share price corrects lower.

Concentration or diversification:

As with any new market, there are going to be winners and losers. If you wish to invest in specific clean energy companies, be conscious of the management expertise, technology the company is employing and the subsidies and concessions available to the company. One way of avoiding this is through investing in a diversified exchange traded fund that invests across different companies within the one energy sector, or across multiple types of clean and renewable energy sectors. This reduces the risk of having a single company go bust, but also reduces the potential returns as investors will have some exposure to companies that underperform along with the companies that perform well.

Highly capital intensive:

New projects into wind, hydro, solar and all other forms of renewable energy are relatively capital intensive. This means that they require large amount of funds to build and integrate their projects. Companies could dilute share ownership by consistently having to raise additional capital to fund ongoing expenses.

Investors also need to be aware of the capital structure of a company, particularly the amount of debt they carry. We are currently in a period of record low interest rates and the likely scenario is that interest rates can only go up from here. If a company is unable to meet its interest obligations on its outstanding debt this could lead to further capital raising and shareholder dilution.

Like with any investment, good due diligence should be the cornerstone of your renewable energy investment criteria. You can contact the Investment Managers at Sequoia Asset Management to learn more about renewable energy investment opportunities.

If you would like to discuss how to get exposure to the Clean Energy Sector, please get in touch by clicking here.

Disclaimer: The information in this document is of a general nature and should not be relied upon as it as been prepared without taking into consideration the objectives, financial situation or needs of any particular person. As a result, before on this information, a person should consider its appropriateness, having regard to their objectives, financial situation and needs. Information from third parties is believed to be reliable, however it has not been independently verified. While the information in the document is given by Sequoia Asset Management in good fair it does not warrant that it is accurate, reliable, and free from errors or omissions. Neither Sequoia Asset management or employees accept any responsibility for errors in or omissions from the information.